Review IC Markets – advantages and disadvantages

Register an IC Markets account here

IC Markets is a broker company was established in 2007 in Sydney, Australia. Group of companies IC Markets provides access to financial markets around the world. The group has offices located in different areas allows IC Markets work with traders from any jurisdictions do legally and comply with local laws. The companies of the group holds the following license: Raw Trading Ltd. licensed by the SFSA (SD018), Seychelles, International Capital Markets Pty Ltd by ASIC(ACN: 123 289 109), Australia and IC Markets (EU) Ltd, regulated by CySEC (362/18), Cyprus. IC Markets is also a member of the Financial Commission, an independent organization, resolve disputes, and available funds insurance with a coverage of up to 20,000 EUR for each trader.

| Currency: | USD, AUD, GBP, CHF, JPY, NZD, SGD, CAD, HKD, EUR |

|---|---|

| Minimum deposit: | $200 |

| Leverage: | From 1:1 to 1:500 |

| Spread: | from 0.6 pips for the Standard account, from 0.0 pips account for cTrader and Raw Spread |

| Tools: | More than 60 currency pairs, CFDS on futures, indices, commodities, metals, more than 2,100 stocks, bonds, electronic money. In total, there are more than 2,100 musical instruments |

| Commands margin call / Stop transactions: | 100% / 50% |

Pros/cons

Advantages

- Trading conditions favorable

- Wide choice of tools, work – over 2,100 property transactions

- Low spreads from 0 pip

- The speed of order execution, high

- The availability of more training materials analysis

- The ability to trade from your mobile device

- The use of the trading advisor is allowed

- Get more useful resources: monitoring the level of disparity, depth risks, calculated risks, and other resources

- The ability to participate in the expansion of scale and risk prevention

- The availability of the Islamic accounts

- Customer service quality

Cons

- No bonuses and additional contest for traders

- Some payments delayed in a few days

- No trades last week

Trading platform IC Platform

IC Social is a cross-platform social trading allows investors to copy the trades transactions of the transaction to their account automatically without delay time.

Features of the platform IC Social:

- Copy trading fully automatically.

- Trading signals. Traders provide signals: enter the date and time into. Investors decide whether to use signal or not.

- Outreach trader, the ability to exchange instant messages between traders.

- Risk management craft, the ability to reverse transactions just by one click.

To become an investor you need to open a real account on MT4, pass verification and deposit money into that account. Next, you need to link your account IC Markets MT4 with his IC Social by entering information to sign into the app IC Social. Traders can sign up the same way and if they are successful transaction, their profile will be displayed in the ranking of copy trading.

Trading conditions

Trading company IC Markets to meet the needs of customers by providing an opportunity to trade at the popular market has high liquidity.

IC Markets offers traders use trading platform MT4, MT5 and cTrader, as well as mobile applications. In particular, there is a wide choice of trading instruments – more than 60 currency pairs, CFDS on futures, indices, commodities, metals, more than 2,100 stocks, bonds, electronic money.

Customers often mentioned in the reviews of them that work fast command execution and low spreads – from 0.0 pips. Spreads on EUR/USD on account Raw Spread is from 0.0 pips (average of 0.02 pips), on Standard accounts – from 0.6 pips (average 0,62 pips). Leverage from 1:1 to 1:500.

Despite the availability of minimum order quantities 0.01 lots is help available deals for traders at any level skill.

| Trading platform: | МТ4, МТ5, cTrader |

|---|---|

| Account type: | Demo, Raw Spread, cTrader, Standard, Islamic |

| Currency: | USD, AUD, GBP, CHF, JPY, NZD, SGD, CAD, HKD, EUR |

| Methods of deposit/withdrawal: | Currency account: in bank Cards and Transfers, transfer from the account of the broker, e-wallets: PayPal, Neteller, Skrill, Union Pay, BPay, POLI, Rapidpay, Klarna, English Internet Banking |

| Minimum deposit: | $200 |

| Leverage: | From 1:1 to 1:500 |

| PAMM account: | No |

| Minimum order: | 0,01–200 (2000–cTrader) |

| Spread: | from 0.6 pips for the Standard account, from 0.0 pips account for cTrader and Raw Spread |

| Tools | More than 60 currency pairs, CFDS on futures, indices, commodities, metals, more than 2,100 stocks, bonds, electronic money |

| Commands margin call / Stop transactions: | 100% / 50% |

Transaction fees

The difference from the broker belongs to the category “roses” transaction, additional fees when withdrawing money belonging to the category “commission non-trading”. IC Markets suggested the commission $6 and $7 for ECN–, respectively, cTrader and Raw Spread. No commission with respect to a standard account type. The company does not charge for most of the account, withdraw money, except for the transaction to withdraw money internationally. The withdrawal of money by the international bank will be responsible for about 20 USD.

| Account type | Spread (minimum value) | Free withdrawals |

| cTrader | 0.0$ | No |

| Raw Spread | 0.0$ | No |

| Standard | $6 | No |

ICMarkets broker is ideal for investment, active and passive

C Markets is a company that provides working conditions most convenient for traders surfing. The speed of order execution of broker is one of the highest speed throughout the world, and the permission to use a mentor is a huge advantage for traders prefer to trade during the day.

The trading server of the company is located in the data center NY4 (New York) and LD5 (London), to maintenance, operator of the broker have used equipment of the highest quality. The server is connected with the suppliers price thanks to the tv optical cable, which is why the speed of order execution is increased and the latency is minimized. Current indicators effective execution of IC Markets is considered to be one of the only the best in the world.

A competitive advantage other of ICMarkets is the use of modern technology to improve the quality of customer service and trading conditions most convenient. Traders can use the tool helps to find out the depth of market indicator price difference temporary and order individual samples. Transactions can also be performed from mobile devices.

Safety

The companies in the group holds the following license: Raw Trading Ltd. licensed by the SFSA, Seychelles, International Capital Markets Pty Ltd by ASIC, Australia, and IC Markets (EU) Ltd, regulated by CySEC, Cyprus.

The reliability of the broker, if confirmed by a permit issued by the management activities in the jurisdictions of different levels. The there are three license of the agency management important global bring to the company capable of providing brokerage services to traders in more than 100 countries.

The method additional protection: coverage up to 20.000 EUR from the Finance Committee; separate accounts, i.e. the customer money is kept separate from the funds the activities of broker at Barclays Bank (Uk), Westpac and National Australia Bank (Australia).

Advantages

- There are clear rules, regulations relationship between supplier and consumer

- Rights and obligations are established for both sides

- The document that describes how to manage the client's money

- Have your insurance company, broker

Cons

- Many documents need to learn skills when working with floor

- Demand from small investors are not accepted

Method of deposit and withdrawal

- Broker IC Markets does not charge a commission for its services, so there are no commission fees when withdrawing money regardless of the account.

- Rose withdraw money through international bank – 20 USD.

- Withdrawal of ICMarkets is done through bank cards Visa and MasterCard, bank transfer, and also through the system of electronic payment: PayPal, Neteller, Skrill, Union Pay, BPay, POLI, Rapidpay, Klarna, Bitcoin Wallet, English, Internet Banking, transfer from the account of the broker.

- Application for withdrawal will be operating departments of IC Markets processed immediately. Getting cash out instantly when using the system of electronic payment and take from 2 to 5 working days after withdrawal of bank cards.

- Withdraw finance on IC Markets is available in 10 currencies: USD, EUR, AUD, GBP, CHF, JPY, NZD, SGD, CAD, HKD.

- Withdrawal requests can be made by the user whose account has been verified.

Customer support

Customer service of ICMarkets activities throughout the day and night, five days a week, from Monday to Friday.

Advantages

- There is a help center

- The search system frequently asked questions

- Multi-language

- There is a callback function

Cons

- Customer service could not be contacted on Saturday and Sunday.

- Live chat is the exception. You can contact the customer service department through live chat 24 hours, including on weekends.

Contact method

| Headquarter address: | Global headquarters of IC Markets at Eden Plaza, Office 222, the Island of Eden, Mahe, Seychelles |

| Organization management: | SFSA, ASIC, CySEC |

| Website: | icmarkets.com |

| Contact: | Email: support@icmarkets.com, Phone: +61 (0)2 8014 4280 |

How to sign up account

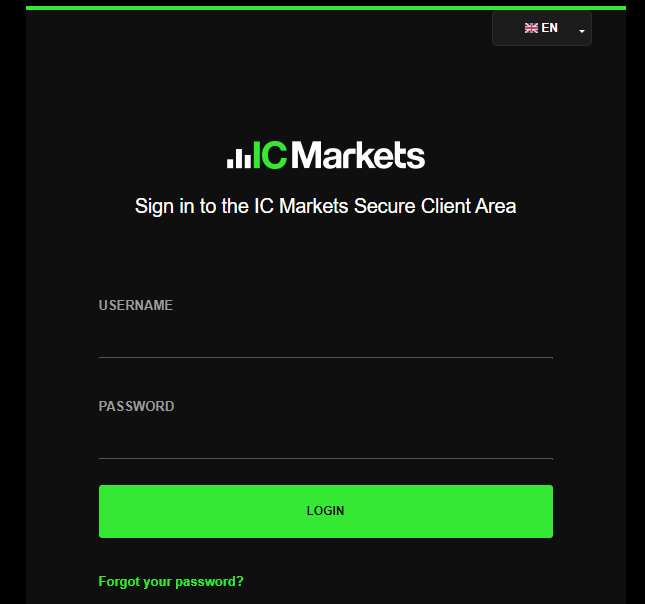

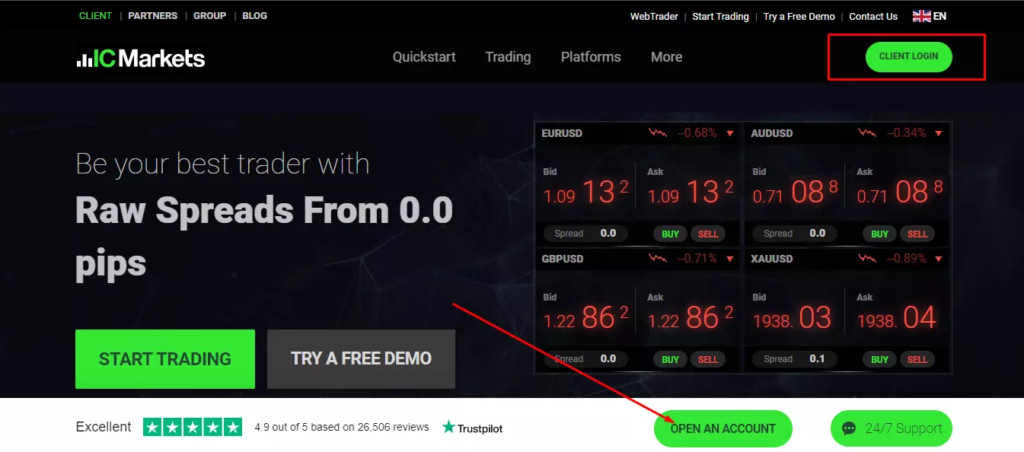

Login to your account from the main page of the site IC Markets by clicking on the button login for customers. If you have not yet registered, click on Open account.

Log in by filling in the fields email and password. Unregistered users need to provide detailed information that account in future will be linked. Just provide authentication information to you don't encounter any issues with the verification of the next.