Review Tickmill – the pros, cons and key features

Register a Tickmill account here

Tickmill is a broker suitable for both professional traders and beginners, suitable company for the transaction by the robot as well as the short-term strategy.

Group Tickmill introduce a new standard in the provision of brokerage services. The focus on innovation is the company proud of and why traders choose it. The trading conditions of the broker is the investment surfing and traders use EA prized for Tickmill provides a minimum group has won many prizes among which there are “arbitrage forex best” and “experience forex trading the best” in the year 2022.

Group company Tickmill include:

- Tickmill Europe Ltd is regulated by CySEC, 278/15 (Cyprus);

- Tickmill Ltd is regulated by the FSA, 09369927 (Seychelles);

- Tickmill UK Ltd is regulated by FCA, 733772 (I);

- Tickmill Asia Ltd is regulated by Labuan FSA, MB/18/0028 (Labuan, Malaysia);

- Tickmill South Africa (Pty) Ltd is regulated by FSCA, 49464 (SAR).

| Currency: | Tickmill.EU – USD, EUR, PLN, CHF, GBP. Tickmill.com – USD, EUR, GBP. |

|---|---|

| Minimum deposit: | 100$ |

| Leverage: | Tickmill.EU – up to 1:30/1:300. Tickmill.com – up to 1:500 |

| Spread: | from 1.6 pips for Classic accounts and from 0 pips for the Pro account and VIP |

| Tools: | Currency pairs and assets on the commodity market, stock indices, stocks, bonds, and cash, electronic |

| Commands margin call/Stop transactions: | 100% and 30% |

Pros/cons

Advantages

- Spreads from 0 pip

- Any any strategy also allowed

- Protection from negative balances

- Trading platform, mobile app

Cons

- The customer support work only 5 days a week from 7:00 to 16:00 GMT

- The relatively small selection of currency pairs

- Don't have a Cent account

- No fiduciary management

The trading platform

- Pelican Trading: This is a cross-platform copy trading simplified for mobile devices with the opportunity to communicate with the signal provider.

- MyFxBook AutoTrader. Here are analytics platform integrated technology of Tickmill. To copy signals, please link your trading account with Tickmill with a user account registered on website MyFxBook. Then start copying the signal after the set limit level of risk.

- Service copy transactions are integrated in MT4/MT5. To copy the transaction, please sign up on the website MQL5 and send money. Link your user account on your platform MetaTrader (for example, through the tab “Signals”) and payment of the registration fee for the transaction have transaction you will copy.

Trading conditions

Trading conditions suitable for both new transactions and experts. Brokers offer some type of account. Broker does not charge for the classic account, this is a good choice for people new transactions, with the difference in transparency. Pro and VIP is ECN account professional with a difference close to 0, execution immediately and fixed charge on each lot. The account is consistent with those who work with the large volume of transactions and use trading strategies high frequency. Minimum deposit for Classic accounts and Pro is $ 100, regardless of the jurisdiction of traders.

Leverage depends on the subdivision of the broker. In Europe, the more stringent conditions. Leverage for retail clients up to 1:30, depending on the type of the property. It can increase up to 1:300 only when status is “Enough standard/Professional” is obtained. For the traders in the other jurisdictions, the conditions are more loyal. Leverage up to 1:500, regardless of status. Virtually every property, except, ETFS and derivative instruments, are available to the transaction (except: futures contracts are available in the United kingdom). The payment method including the banking system and e-wallet. Deposits by electronic funds available for the transaction outside of Europe.

| Trading platform | МТ4, МТ5, МТ4 Webtrader and mobile apps Tickmill |

|---|---|

| Account type: | Classic-VIP-Pro Demo |

| Currency: | Tickmill.EU – USD, EUR, PLN, CHF, GBP. Tickmill.com – USD, EUR, GBP. |

| Methods of deposit/withdrawal: | Tickmill.EU – bank Transfer, Visa, Mastercard, Skrill, Neteller, PayPal, Dotpay, Trustly. Tickmill.com – bank Transfer, Visa, Mastercard, Skrill, Neteller, Webmoney and electronic money payment. |

| Minimum deposit: | 100$ |

| Leverage: | Tickmill.EU – up to 1:30/1:300. Tickmill.com – up to 1:500 |

| PAMM account: | No |

| Minimum order: | 0.01 lot |

| Spread: | from 1.6 pips for Classic accounts and from 0 pips for the Pro account and VIP |

| Tools: | The tools include currency pairs, assets on the commodity market, stock indices, stocks, bonds, and cash, electronic |

| Commands margin call/Stop transactions: | 100% and 30% |

Transaction fees

| Account type | Spread (lowest value) | Free withdrawals |

| Pro | From 0$ | No |

| Classic | From 1.6 pips | No |

| VIP | 0$ | No |

Tickmill is a broker suitable for both beginners and traders with experience

Tickmill is one of the brokerage company combines technology and a wide range of functions. The company offers the trader many educational resources that allow them to get familiar with the forex market and fluent CFD trading. Minimum deposit is Us $ 100 .

Tickmill is a company suitable for the people who deals with many different tools. The company allows the use of mentors and automatically copy the trading transactions. It is also suitable for the transaction according to the news, as well as trading surfing and calm during the day.

Brokers execute the market order pretty fast. On average, this process takes about 200 milliseconds. Traders work with broker transactions through the terminal MetaTrader 4 and MetaTrader 5 downloads. The web platform is also available. Detailed overview about all the trading platforms of Tickmill broker are presented here.

The auxiliary tool of Tickmill is:

- VPS. This is virtual private server offers connection is not interrupted from your foundation to the server. This feature is very useful when you have open positions and stop tracking, but poor connection. Fees start from £30 per month, depending on the number of platforms, RAM, disk space, etc.

- Information graphics: It allows free access to the factors that affect currency quotes, comparison features of MT5, etc.

- Custom tools for MT4 and MT5 necessary for the technical analysis, graphics, and basic.

Safety

Group Tickmill is regulated by The Financial services authority Seychelles (SFSA) and agency Financial Management United kingdom (FCA). This broker also be managed by the Commission securities and exchange Cyprus (CySEC), The Financial services authority Labuan (Labuan FSA) and The Financial sector (FSCA) in South Africa.

Therefore, Tickmill activity according to the regulations of the governing body, this gives the company and the customer all rights and obligations are clearly defined, while ensuring safety for the money.

Advantages

- Client money is kept separate account of the company and are not brokers use

- Protection from negative balances

- Tickmill cooperation with the bank oldest and prestigious

- Broker is a member of the compensation fund for investors ICF. Account insurance in case of a broker bankruptcy up to 20.000 €

Cons

- Management agencies consider the complaint and not as active as the judicial organization. Private traders can hardly get assistance from regulatory authorities in any situations, disputes that.

The option to deposit and withdraw money

- The payment method (deposits and withdrawals) include: Tickmill.EU – bank Transfer, Visa, Mastercard, Skrill, Neteller, PayPal, Dotpay and Trustly; Tickmill.com – bank Transfer, Visa, Mastercard, Skrill, Neteller, WebMoney and electronic money payment.

- Account currency: Tickmill.EU – USD, EUR, PLN, CHF and GBP; Tickmill.com – USD, EUR and GBP.

- The minimum withdrawal amount is $25.

- Broker does not charge any fees to send or withdraw any money, but are free of the payment system.

- Broker will compensation system fee payment in the amount of up to $ 100 if the deposit account of the transaction is not less than 5,000 USD.

- There is a fee is not active.

- Withdrawal requests are processed within 1 working day.

Customer support

Customer support at Tickmill work 5 days a week according to the schedule follows: from 7:00 to 16:00 GMT.

Advantages

- Many choose to get in touch

- Multi-language support

- The site has a section with answers to the most common questions

- You can ask questions that don't need to be a customer of broker

Cons

- Do not work on weekends

- Not active throughout the day and night

Contact

| Registered address: | FSA – 3, F28-F29 Eden Plaza, Eden Island, Mahé, Seychelles LFSA – Office no. 5, Room 25,1 1st floor, Paragon Labuan, Jalan Tun Mustapha, 87007 Labuan F. T., Malaysia FSCA – The Pavilion, Cnr Dock and Portswood Rd, V&A Waterfront, South Africa CySEC – Kedron 9, Mesa Geitonia, Limassol 4004, Cyprus FCA – 3rd Floor, 27 – 32 Old Jewry, London, EC2R 8DQ |

| Organization management: | FSA, LFSA, FSCA, CySEC, FCA |

| Official website: | www.tickmill.com, https://www.tickmill.eu/, https://www.tickmill.co.uk/ |

| Contact method: | Email: support@tickmill.com, Telephone: parts customer support FSA: +852 5808 7849 Customer support of LFSA: +60 16 299 9449 Customer support of FSCA: +852 5808 7849 Customer support by CySEC: +357 25041710 Customer support of the FCA: +44 203 871 3299 |

Instruction register account

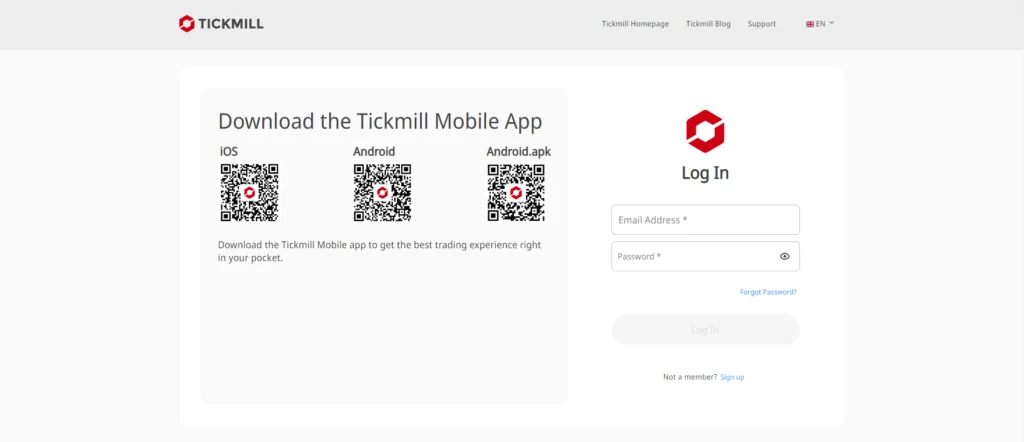

You can enter the Customer area Tickmill his from the main page of the website of the broker. To do this, just click on login.

To login, you need to enter a user name and password of you.

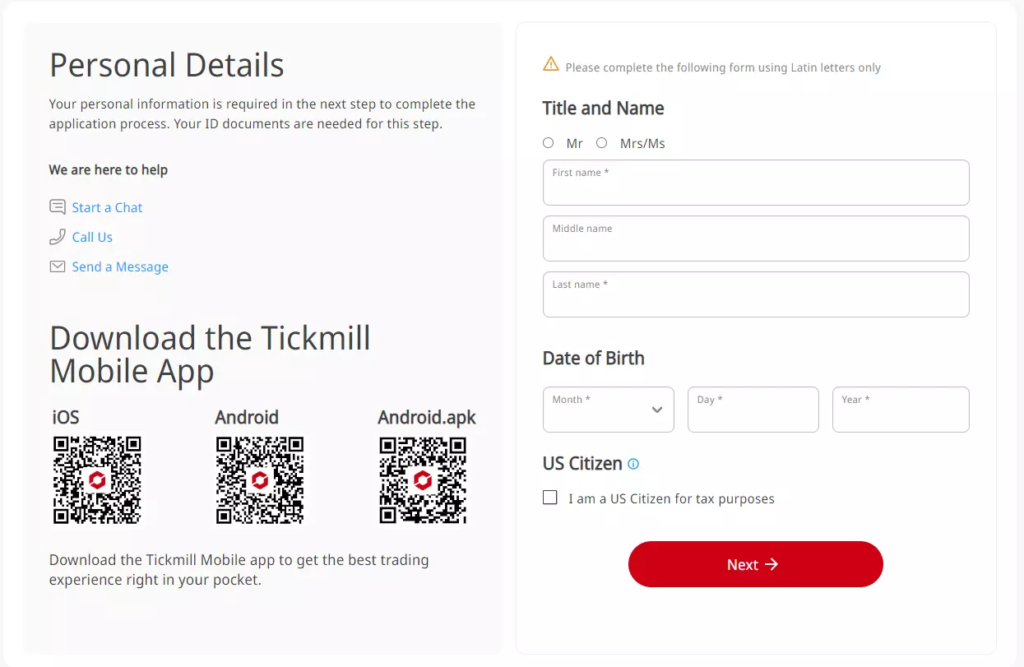

If you have not yet created an account with a brokerage firm, please click on sign up and perform the registration procedure.

After registration and authorization, you can deposit money into his wallet, transfer money to your trading account, your downloads, and platform you choose to start trading.

In customer area, you can upload your documents, view transaction history, send and withdraw money.